So the Fed finishes their two day meeting today. As it relates to mortgages, this is a pretty big deal. It likely doesn’t end well, in the mid term and maybe right away. Rates are going up, it’s just a question of when.

So the Fed finishes their two day meeting today. As it relates to mortgages, this is a pretty big deal. It likely doesn’t end well, in the mid term and maybe right away. Rates are going up, it’s just a question of when.

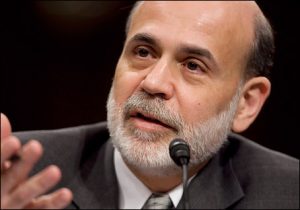

There are only three results from the Fed and Bernanke’s press conference possible. First, they announce an immediate taper and rates instantly resume the upward trend started last spring when the possibility of a taper was announced. Second, they announce the taper is coming, in awhile, likely March. Rates also rise in this scenario, maybe even moreso than the first scenario due to the uncertainty involved. Finally, they say no taper is imminent. Rates likely hold steady, maybe improve a bit over the next couple of days. But not much more than that.

Then there is always the press conference, one pointed statement there and look out, rates could take off.

So in a nutshell, rates are going up…soon. Maybe by alot and maybe as early as this afternoon.

All of this comes from a place of belief that the real estate market, and the general economy are improving dramatically. If you believe that, great. I don’t. But that is a story for another post on another day.